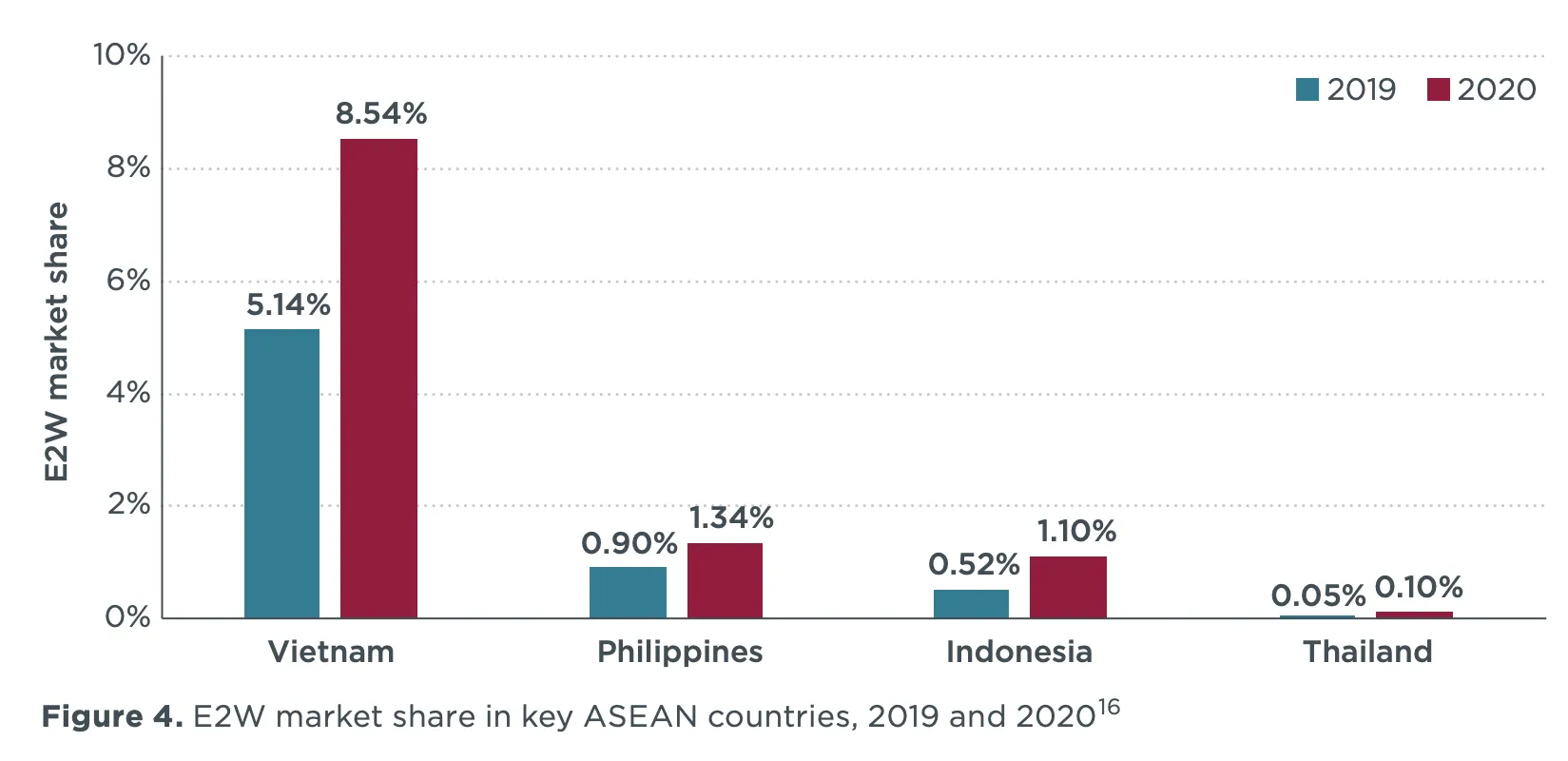

Vietnam ranks fourth in Asia (behind China, India, and Indonesia) for the use two-wheelers (motorcycles and mopeds) for transport. The majority of these are petrol powered and contribute to greenhouse gas emissions and pollution. The national government is relying on a transition to electric two-wheelers to meet its targets for reducing greenhouse gas emissions. By 2040, it aims to end the production, assembly, and import of cars, motorcycles, and mopeds powered by fossil fuels, and by 2050, it wants all motorized road vehicles to be electric and powered by

green energy. Vietnam leads the ASEAN region in electrification of two-wheelers and is second in the world, only behind China. As reported recently, the world is on track for 100 million electric two-wheelers by 2027.

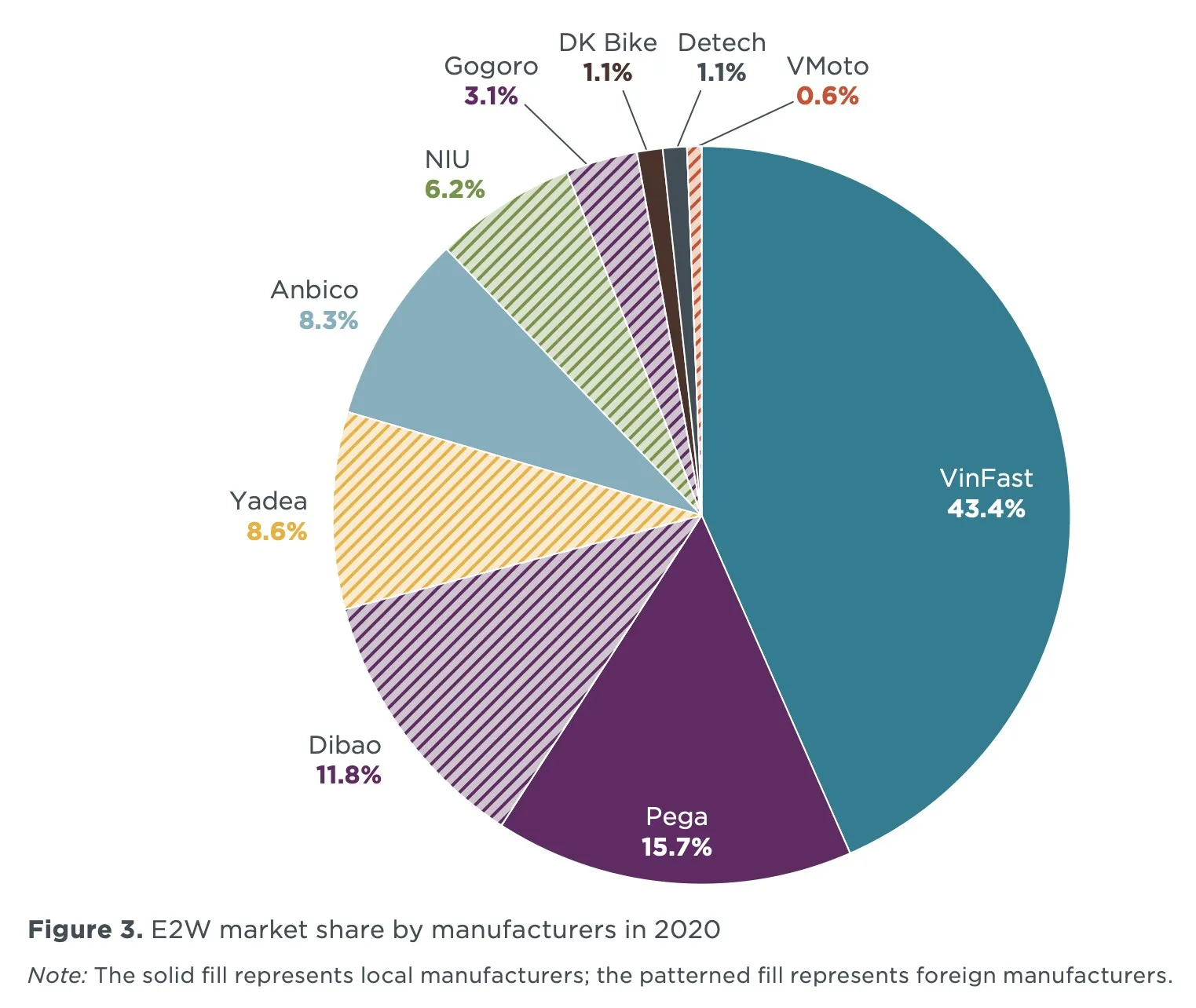

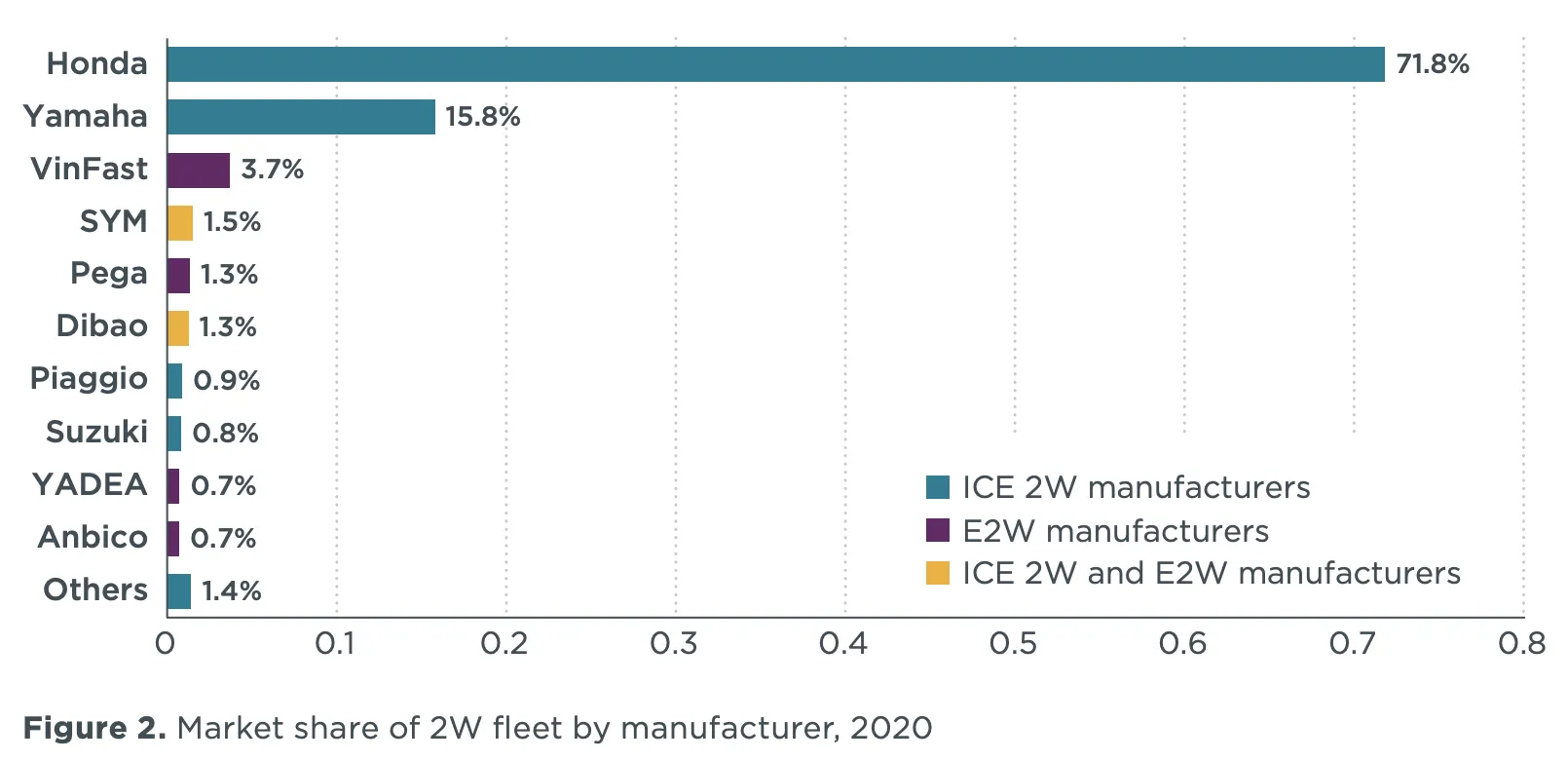

The Vietnamese two-wheeler market is dominated by two Japanese manufacturers, Honda and Yamaha. Ironically, they both manufacture electric two-wheelers, but mainly for export. It is the domestic manufacturers — VinFast, Pega, Yadea, and Anbico — that are offering electric two-wheelers to the people of Vietnam, with VinFast and Pega owning 60% of the electric two-wheeler (E2W) market. Will Honda respond to this market opportunity and offer its electric two-wheelers to the local market? Yamaha has introduced the E01 and it appears to be available in Vietnam. It has a lithium-ion battery and a range of 80 km.

VinFast has a current annual production capacity of 250,000 vehicles, with plans to expand to 1 million. This might mean that exports to other ASEAN countries are possible. It must be noted that the majority of E2W models from all manufacturers are e-mopeds (54 models); only 14 aree-motorcycles (8 of these models are fromVinFast).

Only 12 of the 68 models are equipped with lithium-ion batteries. These are mostly from VinFast. Several of VinFast’s E2W models are powered by LFP (lithium ferrous phosphate) batteries that have been developed by VinFast (in collaboration with Gotion High Tech from China). “VinES Energy Solutions, a unit of Vietnam’s largest conglomerate Vingroup JSC and China’s Gotion High-Tech, have commenced construction of a $275 million battery factory in the Southeast Asian country,” according to Vingroup in late November.

“The factory in the central province of Ha Tinh will annually produce 30 million LFP battery cells.” Production is expected to start towards the end of 2023.

VinFast is also planning to build a battery factory in North Carolina.

There is government support for the introduction of electric cars: such as reducing the special consumption tax and elimination of registration fees. E2Ws with lithium-ion batteries dominate the E2W market.